Which of the Following Is Not a Cost Classification

A contribution format income statement. They form part of inventory and are charged against revenue ie.

Solved Which Of The Following Is Not A Broad Cost Chegg Com

Product costs - are inventoriable costs.

. This problem has been solved. In this article we will discuss about the cost classification by behaviour. Which of the following is not a cost classification.

Cost of sales only when sold. The following classification of cost by its behaviour will give a clear illustration of the above statement. Using the abc classification system for inventory which of the following is a true statement.

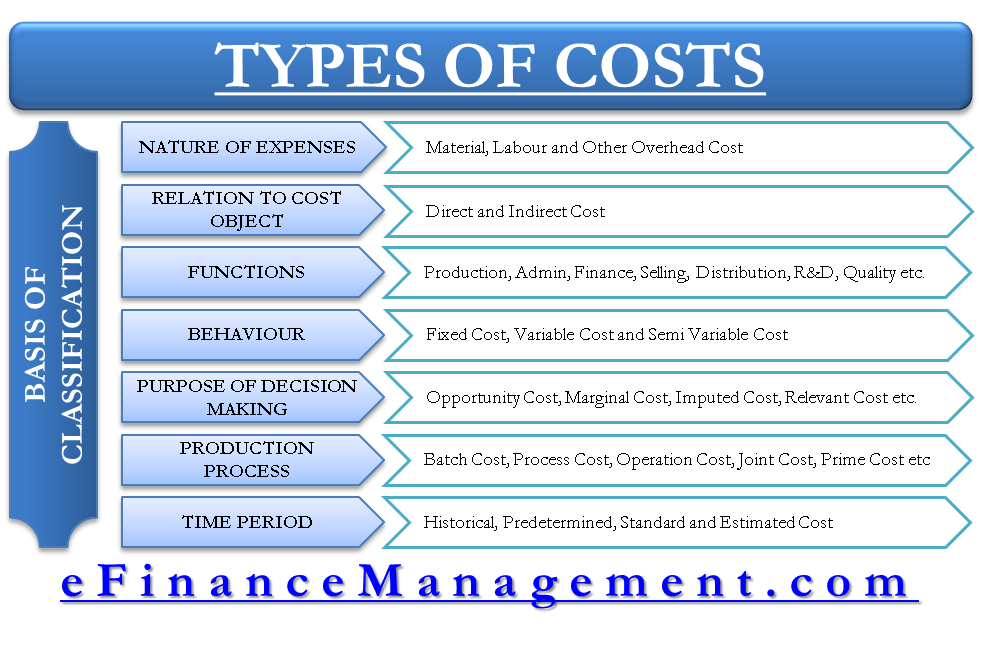

The categories of classification are. Several types of cost classifications are noted below. Cost Classification by Nature 2.

Period costs - are not inventoriable and are charged against revenue immediately. The cost which changes proportionately with the change in. 2 on a question.

Let us divide as per their natures. -Separates costs into their fixed and variable components. So basically there are three broad categories as per this classification namely Labor Cost Materials Cost and Expenses.

All manufacturing costs direct materials direct labor and factory overhead are product costs. We have three suppliers - A B and C. If we buy from C because he is our relative.

Level of activity which the company expects tooperate C. Overhead costs are applied to products on the basis of volume-related measures. The format of the Cost Sheet.

Period costs include non-manufacturing costs ie. Cost Classification for Decision Making 5. Mixed Multiple Variable Fixed.

Which of the following is not a cost classification. Cost Classification by Time 4. There will be a P20 out-of-pocket cost.

Removing expenses that do not differ between alternatives could alter a decision. Which of the following statements about the directindirect cost classification is true. The Relevant Range of activity refers to the.

Geographical areas in which the businessoperates B. Cost classification involves the separation of a group of expenses into different categories. Which of the following is not a cost classification associated with decision making.

A sells the raw materials for P100 per kilo B sells the raw materials for P120 per kilo and C sells the raw materials for P130 per kilo. The following points highlight the five main types of classification of costs. Semi-Variable or Semi-Fixed Cost.

Which of the following is not a broad cost classification category typically used in activity-based costing. Cost Classification in Relation to Cost Centre 3. This is the analytical classification of costs.

The cost which is hardly affected by the temporary change taking place in business activity is known as a fixed costIt includes rent depreciation lease salary etc. Which of the following products is an example of a classification. There will be a P30 opportunity cost.

Cost Classification by Nature. 1 Which of the following does NOT affect the directindirect classification of a cost. Which of the following is not a broad cost classification category typically used in activity-based costing.

Classification of Costs 1 Classification by Nature. These heads make it easier to classify the costs in a cost sheet. Consider the following statements regarding traditional costing systems.

Which of the following is accurate in describing the placement and classification of iodine. A classification system is used to bring to managements attention certain costs that are considered more crucial than others or to engage in financial modeling. Traditional costing systems tend to distort unit manufacturing costs when numerous goods are made that have widely varying production requirements.

See the answer See the answer done loading. See the answer See the answer done loading. Cost Classification by Nature of Production Process.

Student Response Correct Answer Feedback A. Which of the following is not a broad cost classification category typically used in activity-based costing. Sales revenue minus expenses equals ____ ____.

A the level of budgeted profit for the next year B the materiality of the cost in question C available technology to gather information about the cost D the design of the operation. The variable cost is a cost that tends to vary in accordance with level of activity within the relevant range and within a given period of time. Student Response Correct Answer Feedback A.

A method that uses all the available data points to divide a mixed cost into its fixed and variable components is called. The relative proportion of each type of.

Types And Basis Of Cost Classification Nature Functions Behavior Efm

What Is Cost Classification Definition Basis Of Classification The Investors Book

What Is Cost Classification Definition Basis Of Classification The Investors Book

No comments for "Which of the Following Is Not a Cost Classification"

Post a Comment